Congress is gearing up for a massive overhaul of the tax system this summer, bringing a somewhat obscure parliamentary rule into focus.

So, what exactly is Congress doing? How does this work? And why should I care?

To start, Congress will be using a method called Reconciliation. It is a motion that can be used on certain finance bills when they reach the Senate. Instead of needing to pass the 60-vote filibuster threshold, a bill seen under reconciliation will pass with a simple majority.

Republicans are looking to solidify President Trump’s financial goals, which would include a federal tax cut of some kind and would also outline any new funding standards for federal agencies. TLDR; Congress will have to codify the cuts that DOGE and the OMB (Office of Management and Budget) have made to federal jobs.

Senator Markwayne Mullin (R-OK), who serves on the Senate Appropriations Committee, said that this recession and reconciliation package has advice from the president and that the Senate will cut funding to programs and agencies that is not explicitly appropriated under congressional law.

Additionally, the House and the Senate may work on separate resolutions, but they must pass identical bills before the president can sign. The Senate seems to want to separate the reconciliation package into two separate bills— one for tax cuts and one for spending cuts— something the House does not seem to be interested in.

So, what does all of this mean for average people?

- More federal jobs could be cut

Simply, this massive package is a multi-billion-dollar shake-up that includes everything from tax cuts to spending on national security. This package could affect your wallet, but economists still do not know how much. The House bill calls for $1.5 trillion in spending cuts within the current package- a significant decrease in the federal budget.

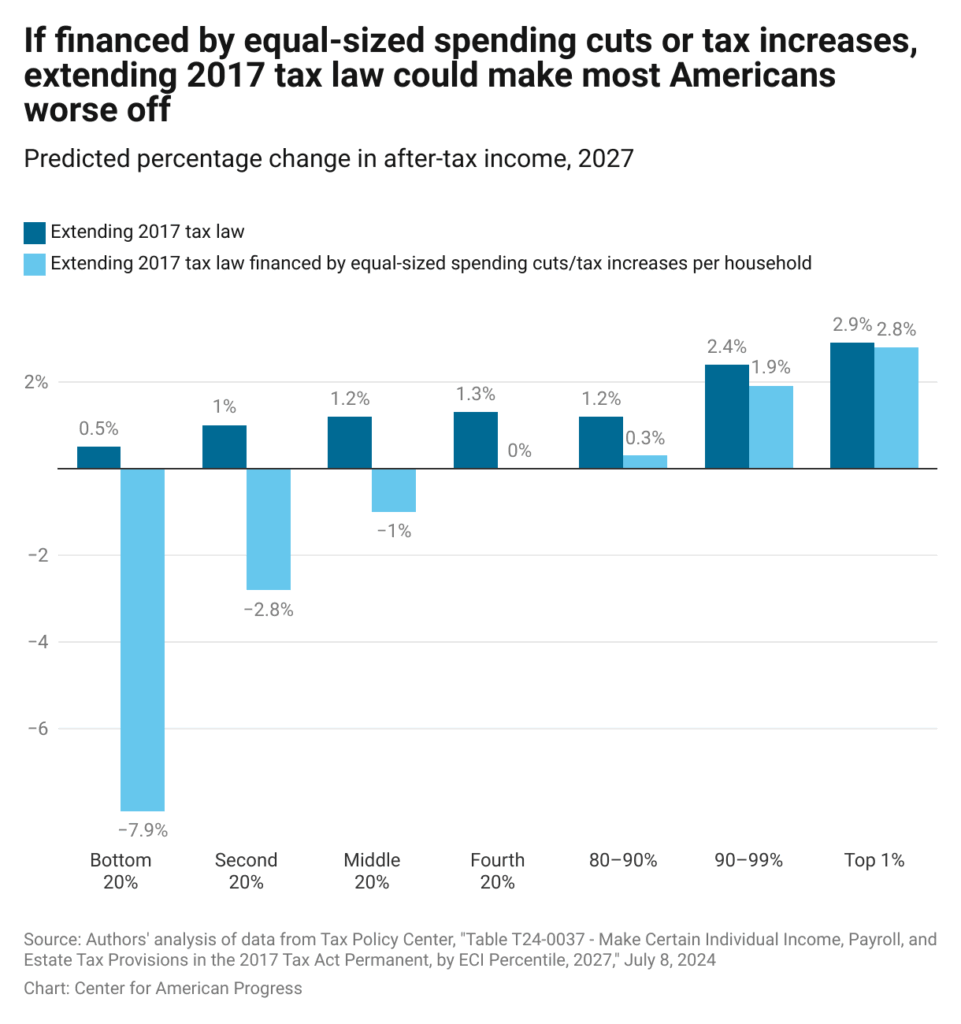

- Expect federal tax cuts

To make tax cuts happen, the federal government has to cut spending to avoid increasing the national debt (an issue close to Republicans), meaning that these two parts of the bill go hand-in-hand. The current House resolution allows for a maximum of $4.5 trillion in overall tax cuts and increases the debt limit by $4 trillion.

- Increase of spending to specific agencies

The current packages from the House and Senate include increases in funding to border patrol, ICE, the Department of Defense, and the Department of Energy, seemingly to help President Trump and the executive branch execute their administration priorities. Defense spending would increase by 13% to $1 trillion, and there is a package for $175 billion to “fully secure the border.” The issue is that these items are unpopular with Democrats, making it difficult for the bill, as written, to make it out of either appropriations committee.

- Cuts to popular agencies and programs

To fiscally balance any spending increases, the budget would have to decrease spending in other areas such as the National Parks Service, the National Institutes of Health, the Centers for Disease Control, and the Department of Education.

This bill package will be one of the largest updates to federal spending in decades and will follow in the policy footsteps of the first Trump administration.

Over the coming weeks, Congress will continue to negotiate and work on this package while also updating appropriations bills for the next fiscal year.