This blog post will be dedicated to an annotated bibliography assigned from the EXPO class, posted here for potential extra credit. Also, I don’t know how to make a hanging indent here, so there won’t be one.

Not every article is annotated fully in “Works Consulted” – why annotate when not used? If that fact hurts my grade, at this point I don’t really have the time to fix that. Just let bygones be bygones.

Argument title: The Slow Death of the American Dream

Goal of the argument: Call out the consistently increasing cost of living (food, housing, general money, etc.) including the factors involved. Something has to change, and it should change sooner rather than later.

LENS TEXTS

Lambert, Hannah Ray. “American Values: ‘It’s Dying’: Parents, Grandparents Worry about Future of American Dream.” Fox News, FOX News Network, 4 Apr. 2024, www.foxnews.com/media/american-values-dying-parents-grandparents-worry-future-american-dream.

- A news article discussing the results of a Wall Street Journal/NORC survey in October of 2023. According to that survey, most Americans do not believe in the American Dream (64%), do believe that life in America is worse compared to 50 years ago (at least 50%), and believe that the economic and political systems are stacked against them (50%). A leading cause for these Americans’ concern is the financial crisis being formed under President Biden’s administration.

- KEY TERMS: American Dream, crisis

- This news article informed me of the growing crisis of American life, so I plan on using it as both a point of reference and my motivation for the research paper.

“American Dream, N.” Oxford English Dictionary, Oxford UP, February 2024, https://doi.org/10.1093/OED/7436541841.

- I needed a definition for the American Dream because the news article failed to provide one. If Google can rely on Oxford, so can I.

- “The ideal that every citizen of the United States should have an equal opportunity to achieve success and prosperity through hard work, determination, and initiative.”

WORKS CITED

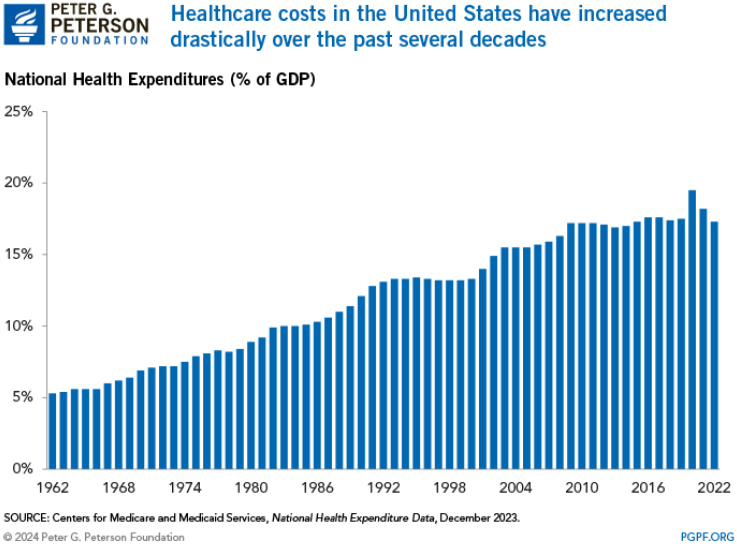

“Why Are Americans Paying More for Healthcare?” Peter G. Peterson Foundation, 3 Jan. 2024, www.pgpf.org/blog/2024/01/why-are-americans-paying-more-for-healthcare#:~:text=The%20United%20States%20has%20one,less%20than%20half%20as%20much.

Digital blog, refer to link.

- Recent data has discovered that Americans have to spend more on healthcare than other countries, the average price increasing steadily in the past 25 years according to charts. Despite the higher cost of healthcare, Americans are not guaranteed better outcomes compared to other countries.

- KEY TERMS: Healthcare, outcomes, COVID-19, costs

- While not in direct dollar values, the data provided in this blog is valuable evidence of expensive healthcare in America.

- Technically “Figure 1”, not listed as such. Would refer to source listed, but no link provided.

Adjemian, Michael K., et al. “Factors affecting recent food price inflation in the United States.” Applied Economic Perspectives and Policy (2023).

[file too large to upload]

- Since the year 2021, food prices increased rapidly due to multiple causes, notably the COVID-19 pandemic and Russia invading Ukraine. Most of the rising prices are supply-side, but the money supply played a part in this hike more than it ever has in history.

- KEY TERMS: Decomposition, demand, food prices, inflation, supply

- This article contains researched evidence and data that proves how prices have increased, especially recently.

- Figure 3a – Consumer Price Index (average prices) of food in the past 20 years.

Anthony, Jerry. “Housing affordability and economic growth.” Housing policy debate 33.5 (2023): 1187-1205.

- The amount of reasonably-priced houses in America is at a worrying low, with a majority of households paying more than 30% of their income on housing costs, deeming them as housing cost-burdened. Because of these circumstances, a majority of the national Gross Domestic Product (GDP) is hindered, holding back the U.S. economy. Producing more affordable housing would greatly improve the country’s welfare.

- KEY TERMS: Housing, quality of life, GDP, economy, economic growth

- I plan to utilize this article as evidence to America’s housing issues. If a house requires a large portion of income to own and maintain, why bother owning the house in the first place?

- Figure 1 – Coverage of America by housing cost-burdened households.

Babones, Salvatore. “Perspectives on median income stagnation in America, 1973 to today.” Proceedings of the 10th Conference of the Australian Society of Heterodox Economists, 2011.

- In recent years, American wages have declined by 20% for the average 30-year-old, but marginal income taxes have drastically declined as well. Before then, Americans had consistently growing incomes up until the 1970’s. Overall, America has shifted their welfare state to one not too dissimilar to Latin America.

- KEY TERMS: Income stagnation, inequality, income

- I found evidence of wage stagnation in effect here. This is one of two texts I salvaged between the first draft and the final, the second is the text below.

- Figure 1

Tanner, Michael. “The American welfare state: How we spend nearly $1 trillion a year fighting poverty—and fail.” Cato Institute Policy Analysis 694 (2012). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2226525#paper-citations-widget

- This study by Michael Tanner analyzes the government’s spending on many different welfare programs, utilizing multiple charts to display how much money is being supplied to which programs. Tanner reveals that while more money has been invested into welfare relief programs over the past few decades, the poverty rate in America has hardly changed. He concludes by claiming that the U.S. welfare programs are failing to some degree if up to $1 trillion is being invested into them and little to no effect is being produced.

- KEY TERMS: Anti-poverty, poverty rates, welfare spending, welfare program

- This study will serve me well in a counter-argument to my point, revealing the corruption and/or ineffectiveness of welfare relief programs, programs designed to relieve U.S. citizens of their financial struggles. While the government is attempting to relieve the welfare issues of America, their actual effectiveness is questionable.

- “In total, the United States spends nearly $1 trillion every year to fight poverty. That amounts to $20,610 for every poor person in America, or $61,830 per poor family of three.” (Executive Summary, 1)

WORKS CONSULTED (not used)

Anthony, Jerry. “Economic prosperity and housing affordability in the United States: lessons from the booming 1990s.” Housing Policy Debate 28.3 (2018): 325-341.

- Did not have modern evidence – using 1990’s/2000’s data.

Borrallo, Fructuoso, Alejandro Buesa, and Susana Párraga Rodríguez. “Inflation in the United States: recent developments and outlook.” Banco de Espana Article 34 (2021): 21.

- I don’t understand it. Evidence should be easily digestible with little explanation.

Bryan, Michael. “The great inflation.” Federal Reserve History 22 (2013), https://courses.edx.org/asset-v1:SDGAcademyX+MSP001+3T2019+type@asset+block@The_Great_Inflation___Federal_Reserve_History.pdf.

- This article tells the story of a brief period of time after the Great Depression known as “The Great Inflation”, where a series of monetary policies caused inflation and unemployment to rise drastically. Most of those policies were ill-informed or poorly planned out, leading to a brief economic crisis. By the end, these attempts to fix and save America’s economy led to an evolution in macroeconomic theory that upholds itself today.

- KEY TERMS: Inflation, macroeconomic, unemployment, monetary policy, Federal Reserve

- This article may contribute to my conclusion, offering solutions to the constant rise of inflation or encouraging the economy to improve for the lower/middle class. I wouldn’t say we should replicate history word-for-word, but we can learn from history to see how they handled overwhelming inflation.

- “But the Volcker Fed continued to press the fight against high inflation with a combination of higher interest rates and even slower reserve growth. The economy entered recession again in July 1981, and this proved to be more severe and protracted, lasting until November 1982. Unemployment peaked at nearly 11 percent, but inflation continued to move lower and by recession’s end, year-over-year inflation was back under 5 percent. In time, as the Fed’s commitment to low inflation gained credibility, unemployment retreated and the economy entered a period of sustained growth and stability. The Great Inflation was over.” (7)

- Would have been used for conclusion if conclusion proposed solutions. Due to being uninformed and uncertain, this idea was scrapped along with this article.

Couch, Robert M., and Bradley Arant Boult Cummings. “The great recession’s most unfortunate victim: Homeownership.” Joint Center for Housing Studies Harvard University (2013).

- This article outlines a growing issue of establishing homeowners in the United States, explaining how and why it’s becoming harder for people to buy homes in the United States, notably those of African-American and Hispanic descent. The article explains that within recent years, the frequency of soon-to-be-homeowners taking loans to purchase their homes has resulted in distrust between policymakers and buyers, leading to increasing difficulty to foreclose homes. In the end, policies toward homeownership needs to change in order to help willing and able buyers claim the home they’re worthy of.

- KEY TERMS: Policy/policymaker, homeowner/homeownership, loan, opportunity

- The value of homes have increased to the point where loans are practically required to afford one. Because of these circumstances, a sizeable portion of homeowners fall into debt because they tried to buy a home beyond their affordability. Then, because of those debtors, banks and institutions become more reluctant to give loans for homeownership, and housing companies become more reluctant to give out homes. It’s a negative loop caused by dollar value, and it will only get worse with time.

- Conference feedback claimed that loans are irrelevant, so this text was scrapped. It’s a shame that the bibliography feedback said this was my best source.

Ginsburg, Paul B. “High and rising health care costs: Demystifying US health care spending.” Princeton, NJ (2008).

- One valuable cost of life is healthcare, necessary for every life at some point for any reason – life-threatening injuries, treating diseases and symptoms, etc. Not being able to afford healthcare can be extremely detrimental for many Americans, and this article has evidence that it already is unaffordable for many.

- “When health care spending rises substantially more rapidly than GDP, insurance premiums rise more rapidly than earnings. In recent years, the gap between premium trends and earning trends has been particularly large, so that the inability to afford health insurance now affects many in the middle class.” (7)

- Would have been included in main argument, cut for irrelevance to point during section. Except that I brought the idea back and forgot about this.

Goodman, Anne Haiqi. FISCAL STIMULUS POLICY IN TIMES OF MODERN ECONOMIC CRISIS: Evidence from the United States and Japan. Diss. Waseda University, 2020.

- This study investigates how quickly and effectively both the United States and Japan were able to deploy financial stimuli during the 2008 financial crisis and the 2020 Coronavirus recession. Research finds that both countries share similar responses to the crises, including adapting to previous failures. In summary, however, both countries seem to be inefficient towards employing a quick enough response to crisis, the author suggesting a quicker method to sending out relief.

- This article could be used as counter-argument evidence questioning the competency and trustworthiness of the government in their ability to provide relief. The cases referred to in the article were major events, though who’s to say that America is not heading towards another crisis right now?

- Cut due to counter-argument confusion (only one counter was necessary).

Kahn, George A. “Dollar Depreciation and Inflation: Agricultural and Business Conditions, Tenth Federal Reserve District.” Economic Review – Federal Reserve Bank of Kansas City, vol. 72, no. 9, 1987, pp. 32. ProQuest, https://login.ezproxy.lib.ou.edu/login?qurl=https%3A%2F%2Fwww.proquest.com%2Fscholarly-journals%2Fdollar-depreciation-inflation%2Fdocview%2F218458158%2Fse-2%3Faccountid%3D12964.

- Data/argument opposed to claim I was looking for.

Mishkin, Frederic S. “Over the Cliff: From the Subprime to the Global Financial Crisis.” The Journal of Economic Perspectives : a Journal of the American Economic Association., vol. 25, no. 1, 2011, pp. 49–70, doi:10.1257/jep.25.1.49.

- Would have been utilized if conclusion included direct solutions. Due to uncertainty, this article was cut.

Palley, Thomas. “Inequality and stagnation by policy design: Mainstream denialism and its dangerous political consequences.” Challenge 62.2 (2019): 128-143.

- Focused on theory over data, not useful. Also, diction too complex.

Parolin, Zachary, et al. “Estimating monthly poverty rates in the United States.” Journal of Policy Analysis and Management 41.4 (2022): 1177-1203.

- Could not understand charts, text too compact. If there was valuable evidence, oh well.

Petach, Luke. “Income Stagnation and Housing Affordability in the United States.” Review of Social Economy, vol. 80, no. 3, Sept. 2022, pp. 359–86. EBSCOhost, https://doi.org/10.1080/00346764.2020.1762914.

[File too large to upload]

- This study by Luke Petach documents a reduction of house ownership and an increase in rent between the years of 1980 and 2016 amongst the bottom quartile. He discovers that this decrease in housing affordability is almost entirely due to income stagnation (for the layman, income that doesn’t increase).

- KEY TERMS: Housing affordability, inequality, wage stagnation, homeownership

- This study will support my main argument since this data is recent enough to apply to modern income and housing prices, and it clearly discusses the problem of inequal income and how that affects housing affordability. The study may mainly apply to the bottom quartile, but that doesn’t mean it can’t extend to higher quartiles in the future with inflation.

- Data focused on bottom quartile, final argument meant to cover average American.

Renwick, Trudi J. “Basic Needs Budgets Revisited: Does the U.S. Consumer Price Index Overestimate the Changes in the Cost of Living for Low-Income Families?” Feminist Economics, vol. 4, no. 3, Nov. 1998, pp. 129–42. EBSCOhost, https://doi.org/10.1080/135457098338338.

- KEY WORDS: CPI, poverty, single-parent families, poverty measurement, Boskin Report, basic needs

- Irrelevant data.

Trostle, Ronald. “Global agricultural supply and demand: factors contributing to the recent increase in food commodity prices.” (2008): 30-pp. https://www.ers.usda.gov/webdocs/outlooks/40463/12274_wrs0801_1_.pdf?v=683.1.

- This study conducted in 2008 reveals that an increase in food commodity prices is being caused by a faster increase in demand compared to the increase in supply, as well as an increase in the cost of production and the devaluing of the American dollar.

- KEY TERMS: Agricultural prices, food prices, prices, supply, demand, global supply, global demand, food inflation, energy prices

- This article reveals and provides a notable cause for the increased price of living – food as a life necessity is contributing to and is being affected by inflation. If the means of production continue to grow more and more costly, many Americans will be forced to A) spend excessive amounts to survive, or B) starve.

- Refer to Figures 1 and 2

- Data was too dated and only pertained to low income households. Considered for conference draft, scrapped for final draft.